Come Ride with Us!

Come ride with us! Weekly local rides on the road and join us for regular special events. Follow us on the Facebook for more ride times and routes.

ATLAS 6.9 FEATURES LIGHTWEIGHT AND ROBUST ALUMINIUM FRAME & FULL-CARBON FORK WITH INTEGRATED C.I.S. CABLE ROUTING, PLUS OPTION TO MOUNT PANNIE...

View full detailsThe Crux is the lightest gravel bike in the world, with the exceptional capability of massive tire clearance and performance gravel geometry. It’s ...

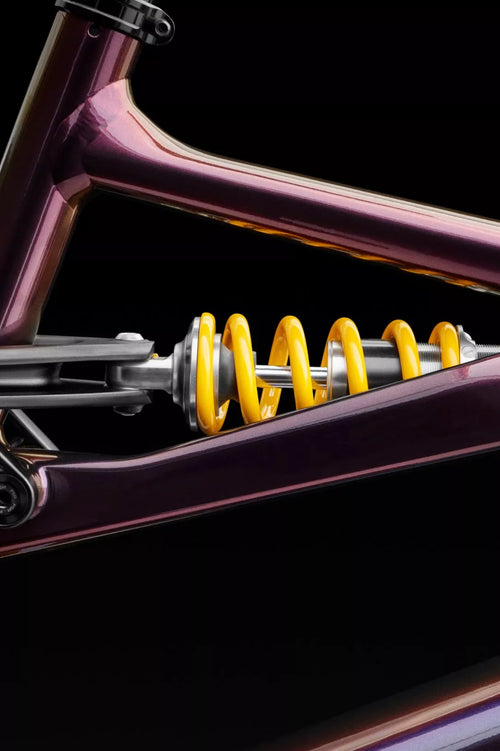

View full detailsDESCRIPTION FEATURES SPECS GEOMETRY & SIZING BUYING A BIKE With Future Shock suspension front and rear, the new Diverge STR delivers compli...

View full detailsDESCRIPTION SPECS GEOMETRY & SIZE BUYING A BIKE Haul Ass, Not Cargo A new breed of rider is emerging—one who loves the freedom and explorat...

View full detailsDESCRIPTION SPECS GEOMETRY & SIZE BUYING A BIKE Haul Ass, Not Cargo A new breed of rider is emerging—one who loves the freedom and explorat...

View full detailsWhether your goal is to escape on gravel back roads, far from cars and crowds, or drop the hammer at the front of your favorite gravel race, no ...

View full detailsDESCRIPTION SPECS GEOMETRY BUYING A BIKE Haul Ass, Not Cargo A new breed of rider is emerging—one who loves the freedom and exploration that gr...

View full detailsDESCRIPTION SPECS GEOMETRY BUYING A BIKE Haul Ass, Not Cargo A new breed of rider is emerging—one who loves the freedom and exploration that gr...

View full detailsDESCRIPTION SPECS GEOMETRY BUYING A BIKE Haul Ass, Not Cargo A new breed of rider is emerging—one who loves the freedom and exploration that gr...

View full details

Slay more of the biggest trails like never before with the all-new Kenevo SL 2. Elevating the category-defining ride of our award-winning Enduro ch...

View full detailsSlay more of the biggest trails like never before with the all-new Kenevo SL 2. Elevating the category-defining ride of our award-winning Enduro ch...

View full detailsSlay more of the biggest trails like never before with the all-new Kenevo SL 2. Elevating the category-defining ride of our award-winning Enduro ch...

View full detailsSlay more of the biggest trails like never before with the all-new Kenevo SL 2. Elevating the category-defining ride of our award-winning Enduro ch...

View full details

Nothing is faster than the Tarmac SL8 thanks to a combination of aerodynamics, lightweight, and ride quality previously thought impossible. After e...

View full detailsThe new Tarmac is designed to go fast, there’s no if’s, and’s, or but’s about that—but it represents so much more than just aerodynamic prowess. Wi...

View full detailsThe new Tarmac is designed to go fast, there's no if's, and's, or but's about that—but it represents so much more than just aerodynamic prowess. Wi...

View full detailsThe new Tarmac is designed to go fast, there's no if's, and's, or but's about that—but it represents so much more than just aerodynamic prowess. Wi...

View full detailsNothing is faster than the Tarmac SL8 thanks to a combination of aerodynamics, lightweight, and ride quality previously thought impossible. After e...

View full detailsNothing is faster than the Tarmac SL8 thanks to a combination of aerodynamics, lightweight, and ride quality previously thought impossible. After e...

View full detailsNothing is faster than the Tarmac SL8 thanks to a combination of aerodynamics, lightweight, and ride quality previously thought impossible. After ...

View full detailsOPENING HOURS

Tues-Fri: 8am-5.30pm

Sat: 10am-4pm

Sun-Mon & Public Holidays: Closed

ADDRESS

242 Thorndon Quay, Pipitea, Wellington 6011